When we put out our initial predictions for the 2023 real estate market, we knew the months ahead could be volatile ones for the industry. Rapid changes and an uncertain outlook for the economy had many in the real estate industry and beyond wondering how the market might fare, resulting in home price forecasts that were all over the map.

Now that we’re at the halfway mark for the year, it’s time to check back in on the market and think about what the rest of 2023 might look like. If you’re looking to buy a new home, sell your home, or invest in the real estate market, read on for our take on the back half of the year.

Low demand, even lower supply

We originally predicted that the market would see a tug-of-war between lower buyer demand and reduced inventory, and so far that outlook has been right on the money. Purchase rate locks, an indicator of buyer demand, have dropped roughly one-third from their 2019 levels, which would typically result in material downward pressure on home prices.

However, active listings have plummeted to roughly half of their 2019 levels, meaning that supply has actually gotten tighter over that time. This dynamic has buoyed home prices in 2023, which have gone down a modest 3% year over year despite a 20% decline in overall transactions and a 25% drop in new listings.

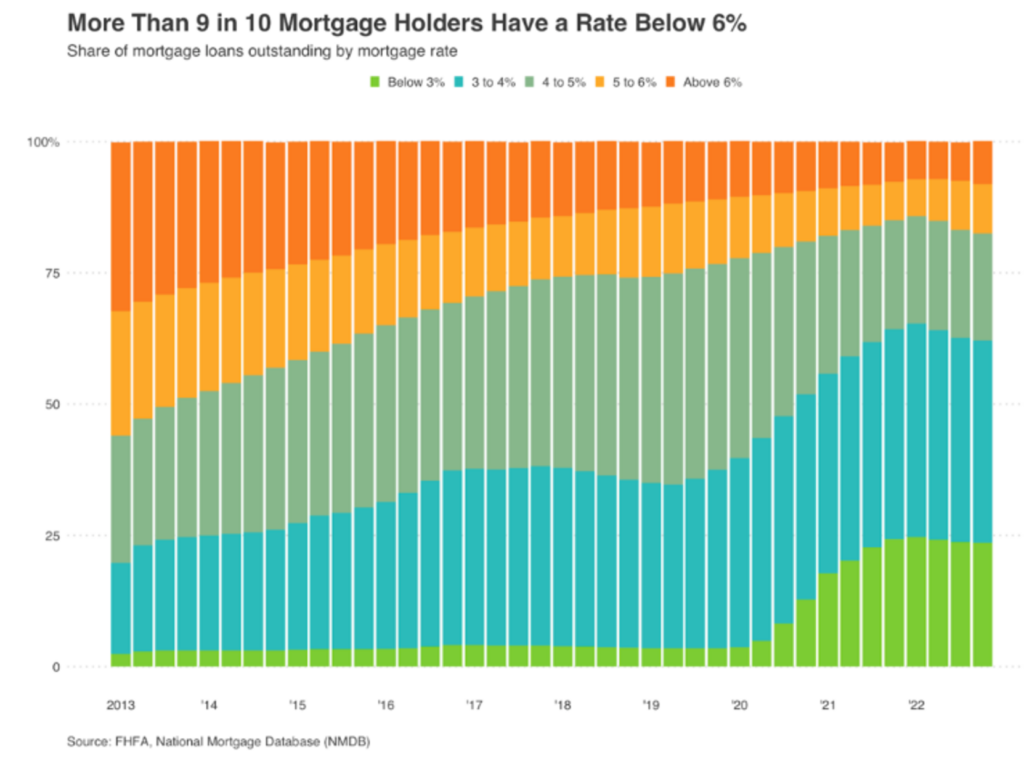

What does that tell us? As we said in January, the housing market is still in sellers’ hands because they’re in the best position to wait it out. Currently, over 90% of mortgage holders have a rate below 6%, and 60% of them have a rate below 4%.

With current rates hovering around 7%, these homeowners would be taking on thousands of dollars in incremental interest expense every year if they sold their current property and purchased another. This dynamic will continue to have a powerful suppressing effect on inventory, putting a floor under home prices in the near-term.

Could this change in the coming months? Absolutely, but it all depends on the economy. Should the United States experience a recession in the coming quarters, then the corresponding increase in unemployment would certainly herald a shift in the housing market.

Homeowners facing unemployment or underemployment in a negative job market would be in a position where they need to sell to avoid the negative impact from foreclosure or lapsed payments. This would likely increase supply and put pressure on home prices as the effects of sharply reduced buyer demand are more fully realized.

Rental growth decline will provide attractive alternatives for buyers

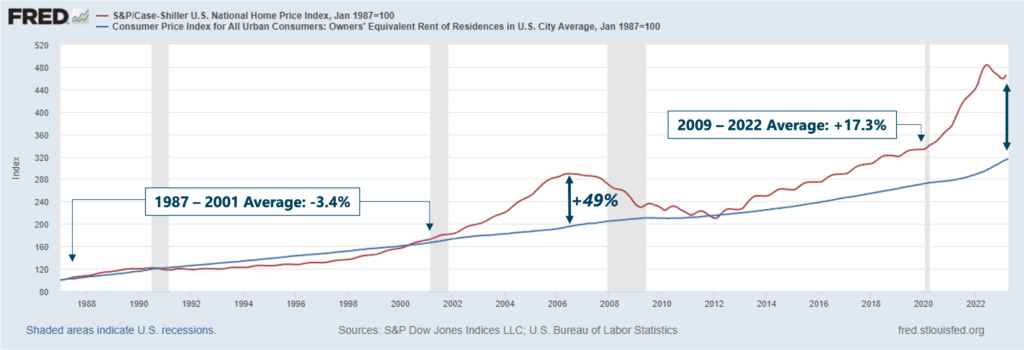

The post-COVID boom in home prices has created a large divergence between the cost of owning a home and the cost of renting. Currently, the gap between the Case-Schiller Home Price Index and the owner’s equivalent rent index has risen to an eye-watering 48%, which is a level last seen at the peak of the housing bubble in the mid-2000s.

A normalization of this buy vs. rent cost comparison without home price declines would require a material acceleration in rent growth. But that doesn’t look particularly likely — rental growth is already slowing down after the big hikes of the past few years and is positioned to decline even more over the remainder of 2023. The rise of new lease rents has slowed significantly, with just a 2% increase from May 2022 to May 2023.

This slowing is quite likely to persist into 2024 as the market digests an additional 500K multi-family units that are expected to be completed in 2023, which would be the largest number of apartment deliveries in 50 years.

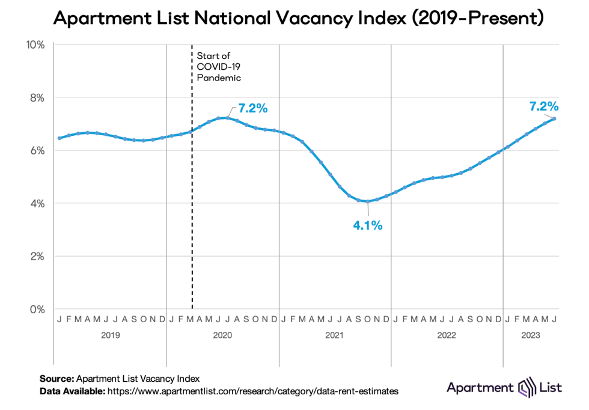

Vacancies are already approaching the highest they have been in five years, returning to their pre-pandemic levels and continuing to accelerate according to Apartment List’s National Rent Report. As existing leases expire in the coming quarters, this will result in increased competition for renters that will exert further downward pressure on rental pricing.

And as rent growth moderates (or potentially turns negative), it will create additional demand headwinds for the housing market as potential homebuyers see more attractive options in the rental market.

The housing shortage is a myth — affordability is the real issue

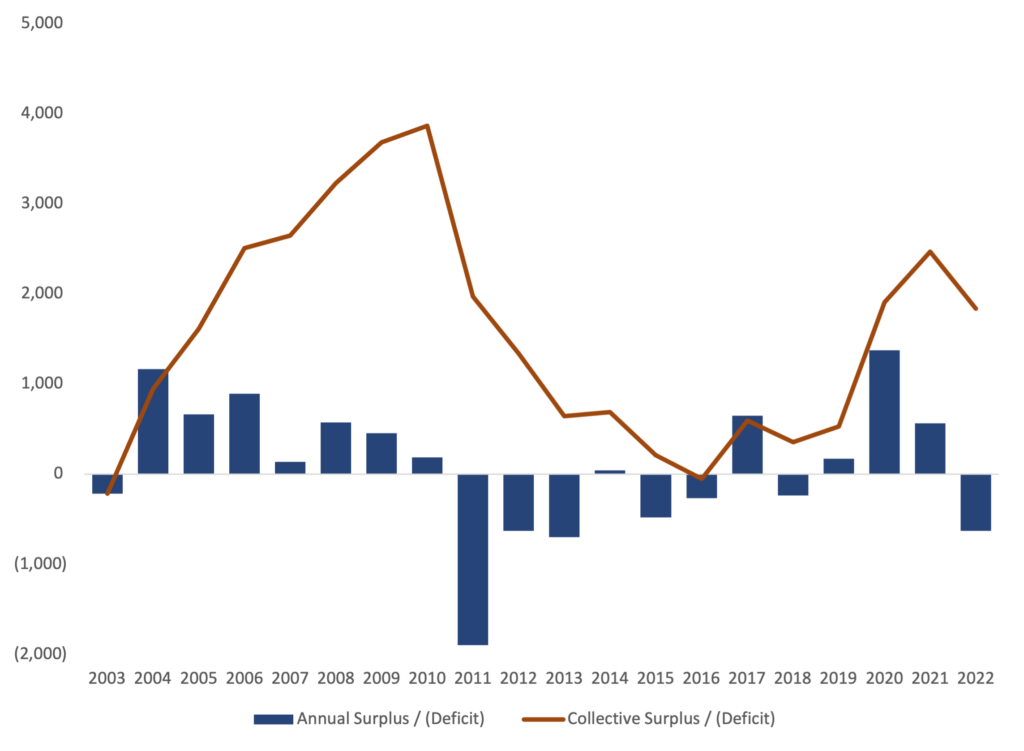

We keep hearing a lot about how there is a shortage of available housing in the United States. However, the data supporting this assertion is flimsy at best. According to the St. Louis Fed, new housing units have outpaced new household formation by 1.8 million units in the last 20 years, and the ratio of housing units per household was in the same in 2022 (1.09 housing units per household) as it was in 2003.

So, if there are enough units of housing to go around, what’s the real problem? Unsurprisingly, it’s affordability.

There is a shortage of affordable housing units that meet would-be homebuyers where they want to be. A particular vacant housing unit might not be in high demand for a number of reasons, but affordability is the chief concern for any buyer in today’s market.

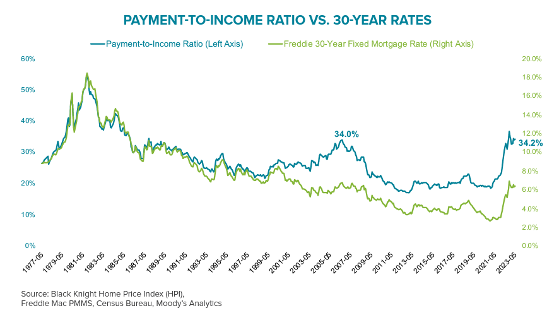

With home prices hovering near all-time highs, the unprecedented pace of interest rate hikes over the past year has created an affordability crisis even more extreme than was seen during the Great Financial Crisis in 2008.

While unemployment, credit quality, and equity positions are much stronger today than in 2008, home buyers can expect mortgage payments to consume more of their income than in any time since the 1980s.

For this ratio of home price to income to come back in line with recent history, it would require either a 50% increase in incomes, a 3% drop in mortgage rates, a 30% reduction in home prices, or some combination of the three.

Our key takeaways for the next six months

While the housing market is facing multiple headwinds in the medium term, the good news is that it does not mean that a crisis is imminent. The economy has been surprisingly resilient despite the sharp rise in interest rates, and extremely low inventories put a floor under home prices in the near term.

However, there are multiple powerful headwinds facing a housing market that has seen values soar by roughly 40% in just over 3 years. While some other market commentators like Zillow and Corelogic have turned more bullish in their forecasts, we have a more cautious outlook that sees flat to declining prices over the next few years as the market digests the massive pandemic-era gains.

For real estate investors, this environment requires a more disciplined approach to sourcing and underwriting deals. Previous assumptions on rent growth and home price appreciation should be revisited to reflect the changing dynamics in the market, and property cash flows should take precedence in prioritizing potential deals.

Investing in real estate has been and — in our view — will continue to be a sound long-term strategy for building wealth, but that doesn’t mean there won’t be bumps along the way. Being aware of changes in the marketplace and adjusting your investment strategy accordingly will help ensure that you can ride out any short-term storms and realize your long-term investment goals.