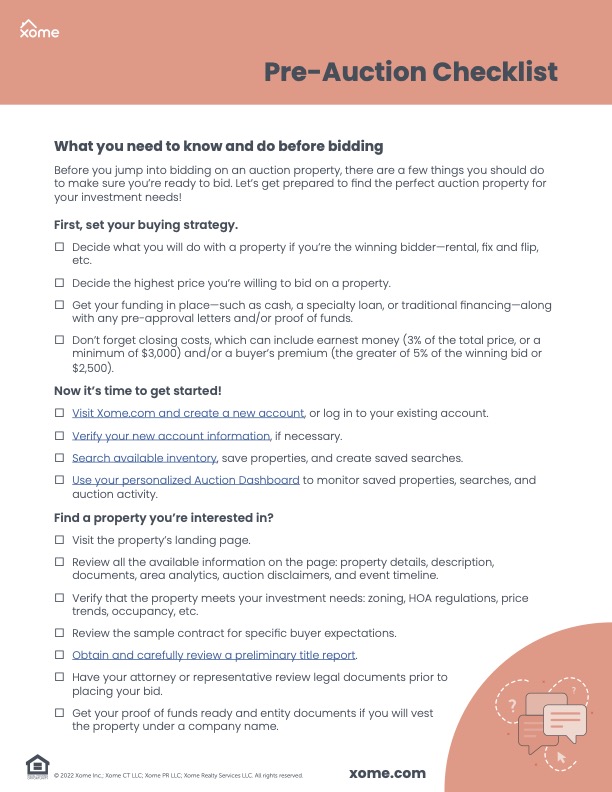

Download a pre-auction checklist to use before you bid, the first time or every time!

Before you bid on a property, it’s important to be ready with all the essentials: a solid buying strategy, the right research, and your paperwork ready to go if you find yourself the high bidder.

So what does that mean? We’ve broken it down for you — these are the must-consider things you should be thinking about before you register and bid on a property to give you a head start before putting your money in the game.

Pull together the elements of your buying strategy

Because there’s so much to think about before you buy, some things can be easily overlooked by first-time buyers when it’s time to make big decisions. It’s helpful to have a plan in place before participating in an auction so that you can feel confident about getting into the bidding process.

What are you going to do with the property once you own it?

Determine what your owning strategy will be if you are the winning bidder. It could be a fix and flip, a rental, or even a potential wholesale (that is, purchasing the property for a specific amount, and then immediately selling it to someone else for more money).

How are you going to fund your purchase?

Are you planning to pay cash, get a specialty loan, or secure traditional mortgage financing? Think through how you will pay for the property ahead of time.

What’s your “best and final bid?”

Decide the highest price you’re willing to bid on a property.

What are the closing costs on the property?

Read the fine print on a property’s page to confirm what your estimated closing costs will be and what’s included, such as auction fees like a buyer’s premium (e.g., 5% of the winning bid amount or $2,500, whichever is greater), your earnest money deposit (e.g., 3% of the total purchase price or a minimum of $3,000), or any liens you might be responsible for paying off.

How will this property be vested?

Will the property be listed in your name or the name of an entity (like an LLC)? If it’s an entity, make sure you have all the paperwork ready like the operating agreement and proof of funds.

What is the total purchase price you can expect?

Estimate your total purchase price so you’ll know the approximate amount you’ll be paying at closing. The total purchase price is usually the winning bid amount plus the buyer’s premium, if applicable.

Is the property occupied?

First, check the property’s page to figure out if it is occupied. If it is occupied, investigate the rules for how to handle occupancy in the city/state where the property is located.

Please note that prior to closing on an occupied property, it is critical that you never disturb the occupant. It may be tempting to visit the property out of curiosity, but it is a criminal offense to trespass!

Make sure you do the proper research before you bid

Due diligence

We highly recommend doing your research before bidding on a property. This very important step may include looking up the estimated value, reviewing title reports, estimating any repair costs, and visiting the property and surrounding neighborhood (when possible). You may need to contact various real estate professionals based on what you need to know.

Have your financial documents ready

Get ready to have proof of your cash on hand!

If you’re paying cash, you will need proof of funds such as the last 60 days of your bank statements.

Don’t forget your mortgage paperwork!

A pre-qualification or pre-approval letter will need to be uploaded to your auction dashboard once you win the property. Don’t have one yet? There are some great options for financing your purchase.

Are you ready to get bidding on auction properties? This handy checklist will help you get prepared to find the perfect auction property for your investment needs!