Property valuations play an important role when purchasing a home. Typically, valuations are used to determine the economic valuation of a property. They can help potential property buyers strategize investments, secure financing, or negotiate more effectively with sellers if a property valuation comes in below asking price.

However, formal appraisals can be expensive and may not always be an available option for every property before purchase, such as with auction properties. That is why automated valuation models (AVMs) are useful tools to quickly estimate property values through algorithmic analysis.

They differ significantly from traditional appraisals, which encompass a deeper evaluation of property conditions and specific features. But they can be a great tool to help homebuyers and investors make more informed buying decisions.

The benefits (and limitations) of automated valuation models

One of the most obvious benefits of AVMs is that they’re extremely cost-efficient to use — in fact, many are free to use, like Zillow’s Zestimate, Redfin’s Redfin Estimate, and even our own Xome Value®.

AVMs can also quickly automate property valuations, using data like property characteristics, local market information, property sales, and price trends to automatically provide an estimated value. This automation can help save time compared to traditional appraisal methods. In addition, the objective data used for the estimation helps reduce the potential for human error.

While AVMs have several strengths, they have a few limitations as well. AVMs do not consider the current physical conditions of a property because they are based only on existing data, not on real-time physical inspections. This means they may value properties that feature unique characteristics, recent updates, or are distressed.

AVMs also do not have access to current data on things like sudden fluctuations in the real estate market, which can also affect property values. Time-based factors such as recent neighborhood developments, up-to-the-minute local economic conditions, or specific community attributes might not be fully considered by AVMs.

How automated valuation models can supplement traditional appraisal methods

There is no real substitute for traditional appraisals when it comes to understanding the true value of a property, whether that’s prior to a traditional sale, after purchasing an auction property, when selling a home, or when refinancing.

However, traditional appraisals can be expensive and the process is time-consuming. That is where AVMs can fill the gap with quick, free access to valuation information until a traditional appraisal can be completed.

Using AVMs alongside formal appraisals can be a valuable tool for making any property purchase decision. By considering both sources of information, buyers, sellers, and investors can obtain a more well-rounded valuation than by just using one or the other.

One way to utilize AVMs effectively alongside traditional appraisals is validation and benchmarking. Comparing AVM results with values determined through traditional appraisal methods can provide additional insights to help you with your decision.

This validation process allows for a comprehensive assessment of the property’s value and provides a benchmark when comparing to similar properties in the market. Buyers can then assess the competitiveness of the price by analyzing the estimated value in relation to comparable properties and determine if the property is overpriced, underpriced, or aligned with market trends.

AVMs can also be leveraged to identify potential errors or inconsistencies in property valuations. If the AVM result significantly differs from the traditional appraisal, it may indicate the need for further investigation.

This can be an indicator for sellers that they may need to get a second appraisal to confirm the value of a property, or a flag for potential buyers that a property might need a deeper look. Cross-referencing and validating the outputs of AVMs and appraisals can help ensure the reliability of the valuation and mitigate risks or errors.

Using the Xome Value for property research

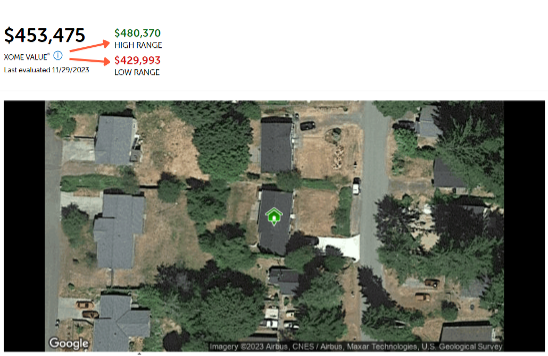

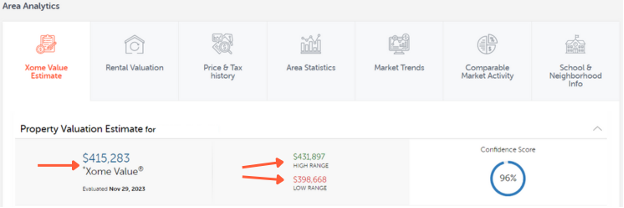

The Xome Value generated by the Xome® valuation model is a great example of how to leverage AVMs for initial property research and analysis. The Xome Value is displayed on all listings when using the Xome website or application to search for properties. The generated Xome Value includes both the low and high ends of the estimate.

When looking at auction listings on Xome, the property valuation estimate will appear with its high and low ends of the Xome Value along with its confidence score. The confidence score indicates the predictive power of our valuation methods.

Keep in mind that many auction properties do not allow tours, inspections, or appraisals prior to purchase, which is why an AVM like the Xome Value can be so helpful. These numbers can be used for initial property assessments, comparing market prices, and data analysis of market trends. After an auction purchase, a local realtor or appraiser can help with a more thorough investigation into the property and additional details that may not have been captured in the initial property value estimate.

While they’re not a replacement for a traditional appraisal, AVMs can be a great tool to use for property research, listing properties for sale, and investment strategy planning. Leveraging a balanced approach that incorporates both helps buyers, sellers, and investors make better data-informed decisions.

Real estate AVMs have changed the industry in many ways, making property valuations more accessible than ever before and helping simplify the home buying and selling process in new ways. Thanks to AVMs people can approach real estate transactions with more informed, data-driven strategies for success.

Are you ready to find your next deal? Sign up with Xome today to check out our auction and retail inventories and use the Xome Value to help you find the perfect property.