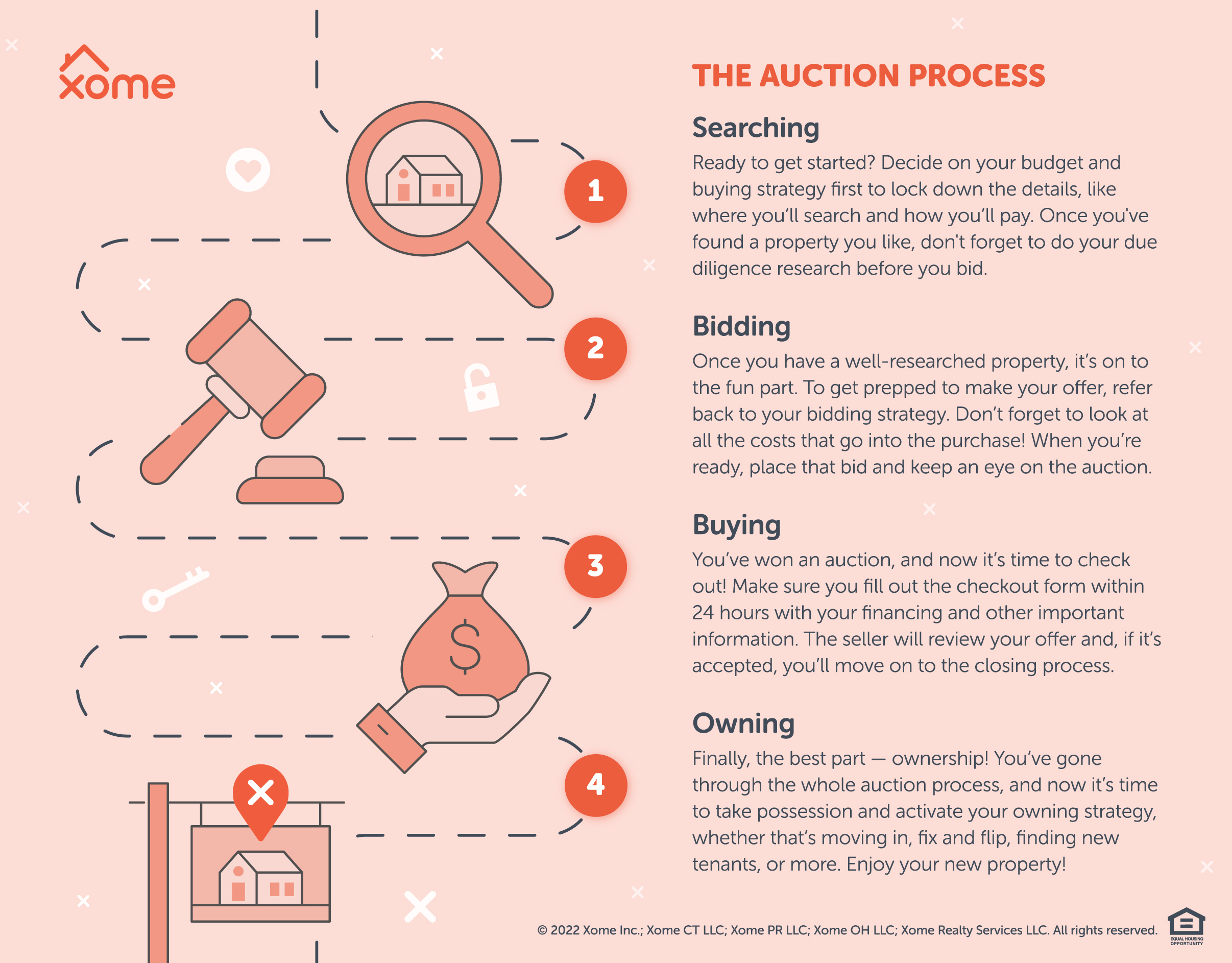

Auctions can be a great way to get started in real estate investment or even buy a family home at a great deal. But how do real estate auctions work? The auction lifecycle follows four main steps: searching for and researching properties, bidding at auctions, buying properties, and finally owning properties. Check out the process below and pick up a few pro tips to navigate each step seamlessly.

Step One: Searching

There’s a lot that goes into your search to make sure it aligns with your buying strategy. Once you figure out your strategy, you can start looking for properties you’re interested in that meet these criteria. Once you identify potential properties, make sure to do your due diligence so you know the history of the property and can make informed bids.

When searching, here are some things to keep in mind:

Auction location

What area are you looking to buy a property? How far away from where you live are you wanting to expand your search? Do you want to stay local? Cross county lines? State lines? Does the quality of schools play a factor?

Buying and owning strategies

What’s your budget? How are you planning on paying for the property: cash or financing it? This can totally be dependent on the house you find, but what are your end goals with the investment property you’re searching for? Buying it for yourself? Fix it and flip? Buy it owner occupied then rent it out?

Researching and due diligence

You definitely want to make sure you do your research so you can feel confident in the property you are interested in. Through the due diligence process, you may end up saying, “You know what, this property isn’t for me,” or it may be just what you’re looking for!

In fact, we highly recommend that you conduct due diligence, or research, on any property before registering for an auction. Take a look at our article on due diligence for more on how to conduct this research.

Step Two: Bidding

This is the exciting yet sometimes nail-biting part of the auction process. Once you have a well-researched property (or more!) that you feel confident bidding on, it’s time to think about your bidding strategies to prep for the auction.

Prior to the auction starting, here are some things to consider:

Pre-auction offers

Some properties allow you the option to make an offer before the bidding in an auction even starts.

Your minimum and maximum bid amounts

To bid, you need to submit a number that is at least the bid amount that appears on the screen. This is the minimum amount you can bid. The bidding will increase in increments throughout the auction. If you get outbid, you can submit a higher bid as long as it is equal to or greater than the bid amount shown on the screen.

Total auction purchase price

Don’t forget to look at all the costs that go into the purchase price of the property. This can affect what your minimum and maximum bids could be. The total purchase price is usually the winning bid amount plus the buyer’s premium, if applicable.

Bid increments during the auction

Increments are pre-determined based on the current high bid. As the bidding continues, the auctioneer may reduce the size of the increments if there is little to no bidding activity.

If you don’t want to deal with the back and forth of bidding in increments, you can also submit your best and final bid as long as it is higher than the current bid amount.

Step 3: Buying

So far, you have bid like a pro and won an auction. Now what? The buying phase is next, including how you’ll pay for the property, fees associated with the property, documents you need to close, title, and the general closing process.

The important things to understand during the auction buying process:

Financing

Depending on the property, you will need to have cash ready to go to purchase the property. This could be in the form of a cashier’s check, a specialty loan, or a traditional mortgage. You’ll also need to submit the earnest money deposit (the amount you pay that lets the seller know that you are serious about buying the property) within 48 hours of winning the bid.

Fees

The fees associated with buying will vary by property, but generally include the total purchase price, buyer’s premium (if applicable), the earnest money deposit, closing costs, and attorneys’ fees, among others.

Documents

Your immediate next step after winning the auction should be to fill out a checkout form, which must be completed within 24 hours of an auction’s close. The checkout form includes things like how you want the property to be vested (that is, whether you want to put the property in your name or the name of a business entity), how you will be paying for the property (e.g., with cash, a hard money loan, or traditional financing), and which closing office you want to use.

Title

Depending on the property, you will either receive a quitclaim deed, a special warranty deed, or a general warranty deed.

Closing process

With your contract signed, the next step is closing. This is the part where your team and the seller’s team (e.g., closing office agents, title attorneys, etc.) get in touch to finalize closing activities like transferring the title from the seller to you and moving the funds into escrow. The closing process from beginning to end can take anywhere from 10 to 30 days, but usually takes about 20 days.

Step 4: Owning

Finally, the best part — ownership! The auction bidding and buying process is complete and you are now the proud owner of a new property. It’s time to take possession and activate your owning strategy, whether that’s moving in, finding tenants, working through the eviction process, or waiting for occupants to voluntarily vacate. It’s important to know what to consider before deciding which strategy is the best fit.

Different post-auction owning strategies and how they might work for you:

Owner occupied

If you purchase a property that has multiple living spaces, then you may choose to live on site and rent the other spaces out to tenants. Living on the property as a homeowner can be an attractive option because of additional financing options available, like FHA loans and VA loans, which do not apply to typical investment properties.

Owner-occupied properties are similar to renting as-is, or fixing and renting a property, but should not be considered a passive investment. Being on site means you’ll be taking a more active role with tenants when they have needs or questions.

Own for yourself

Congratulations! It’s time to move in. Pack your things, hire movers, turn the key, and enjoy your new property.

Fix and flip

If you’re thinking of fixing up your property and flipping it for sale, think like a successful investor and have a house flipping process in place that you can use with any current and future properties.

This could include purchasing materials at an affordable rate, hiring a crew who can provide quality work at a fair price, working with a real estate agent who specializes in selling flipped homes, and so much more. With the right approach and resources, a fix and flip could take only a few months.

Rent as-is

If the property is in reasonably good shape, one option is just renting it out as-is. Make sure you conduct a screening to ensure you choose successful tenants, research market rents to correctly price your property, and consider using a property management company.

A management company can help with the screening process, manage all the financial transactions and property maintenance, and even assist with evictions when necessary. While they do receive a portion of the rent, this is a good option if you are looking for a passive investment opportunity.

Fix and rent

If you want to fix your house and then rent it out, we suggest following the guidance for fix and flip and rent as-is properties.

That’s the auction lifecycle from start to finish. If you’ve made it this far, you may be ready to jump into the process of purchasing an auction property. Take a look at the properties up for auction on Xome.com and start putting together your own bidding strategy!